Although there is still some uncertainty, the latest figures available from the Spanish National Statistics Institute corroborate the good economic predictions and suggest that the property market is also on the road to recovery. We analyse the situation in Barcelona, district by district, in terms of sales and prices.

After an unsettled period, it seems some good news for the Spanish economy might be on its way. The Bank of Spain recently released its second quarterly report on the Spanish economy, where it predicted a GDP growth of 6.2% this year, an increase of 0.2% on the previous forecast, and also suggested that the growth rate of the Spanish economy would reach pre-pandemic levels by 2023.

Find out now the value of your house or flat from our valuation page. Click on the link below:

We value your flat or house in Barcelona

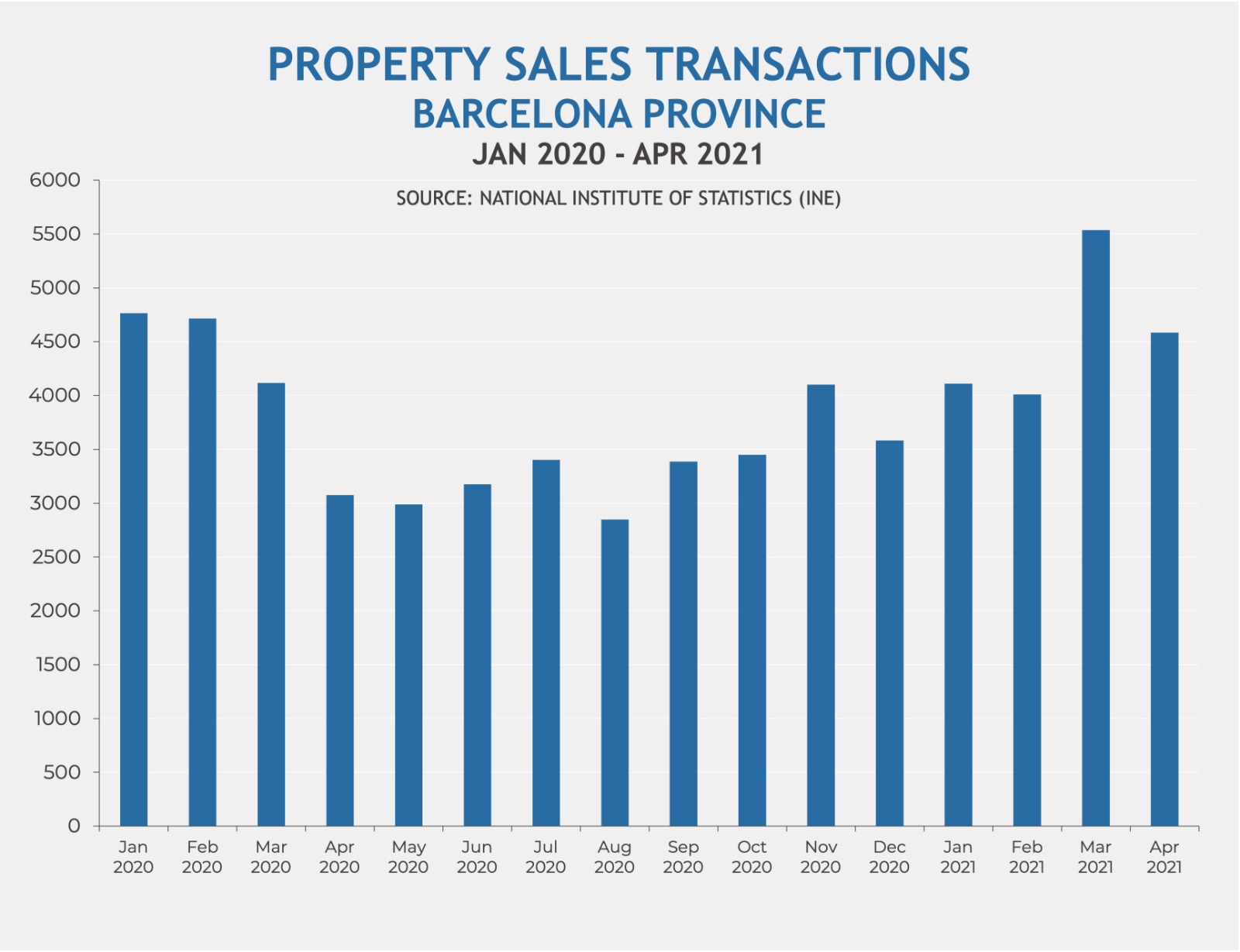

Although a degree of uncertainty of course remains, the latest figures available from Spain’s National Institute of Statistics (INE) corroborate these predictions and suggest that the property market could too be on the road to recovery. The total number of sales transactions in the province of Barcelona in the first four months of 2021 (18,237) increased by 9.4% when compared to the number of sales in the same period in 2020 (16,670).

When looking at the number of transactions in April 2021 compared to the same month in 2020, the increase was even more pronounced, with a rise of almost 50%. The recovery will be reliant on the success of the vaccination programme, domestic demand and the holiday property market by international buyers. The foreign holiday property market is expected to fluctuate, depending on travel restrictions.

Number of sales

The number of sales in Barcelona city itself is also increasing, with the latest data from the Generalitat de Catalunya registering a rise of 2.83% when comparing the number of sales transactions in the first quarter of 2021 with the same quarter in 2020. Half of the ten districts in Barcelona registered increases in terms of sales transactions, with the highly desirable district of Eixample leading the way.

- – Eixample: 469 sales (58.5% increase)

- – Sants-Montjuïc: 333 sales (14.0% increase)

- – Gràcia 277 sales (14.0% increase)

- – Barcelona Old Town 224 sales (10.3% increase)

- – Nou Barris 273 sales (1.1% increase)

- – Sarrià-Sant Gervasi 272 sales (0.7% decrease)

- – Les Corts 153 sales (11.6% decrease)

- – Horta Guinardó 359 sales (13.1% decrease)

- – Sant Martí 422 sales (13.4% decrease)

- – Sant Andreu 312 sales (13.8% decrease)

Sale prices

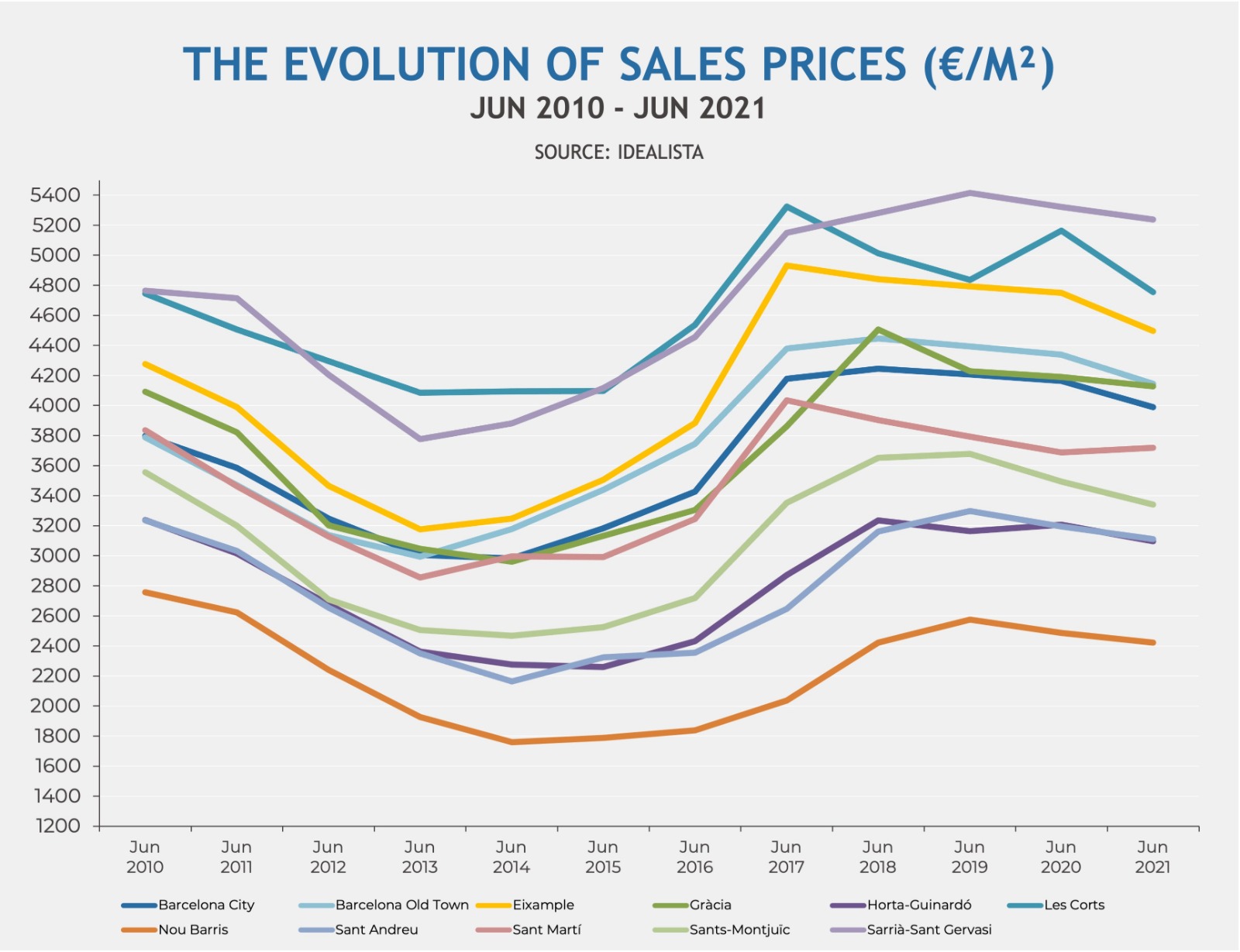

Property prices are also on the up in Barcelona, according to property portal Idealista (who base their data on asking prices). Four of the city’s ten districts registered price rises at the end of the second quarter of 2021 compared to the first quarter of the year, providing yet more evidence that the property sector is beginning to regain momentum.

Do you want to sell your property in Barcelona? Access now to our specific page for owners:

Selling your flat in Barcelona

Prices rose by 1.6% in Sant Martí, 1.4% in Sant Andreu, 1.1% in Eixample and 0.9% in Horta Guinardó. Property prices in the districts of Gràcia and Sarrià-Sant Gervasi remained stable and the remaining districts registered varying price reductions, with the most pronounced being in the districts of Nou Barris and Les Corts, where prices dropped by 3.5% and 3.6% respectively.

- – Sant Martí: €3,719 per sqm (1.6% increase)

- – Sant Andreu: €3,111 per sqm (1.4% increase)

- – Eixample: €4,497 per sqm (1.1% increase)

- – Horta Guinardó: €3,096 per sqm (0.9% increase)

- – Gràcia: €4,127 per sqm (no change)

- – Sarrià-Sant Gervasi: €5,237 per sqm (no change)

- – Barcelona Old Town: €4,144 per sqm (1.4% decrease)

- – Sants-Montjuïc: €3,341 per sqm (2.4% decrease)

- – Nou Barris: €2,422 per sqm (3.5% decrease)

- – Les Corts: €4,755 per sqm (3.6% decrease)

Although prices are beginning to rise, they still have a little way to go to reach pre-pandemic levels. The average property price across the city as a whole at the end of June this year was 5.2% lower than that of June 2019. This trend is apparent in all of the city’s ten districts, with prices registering decreases ranging from 1.7% in Les Corts to 9.1% in the district of Sants-Montjuïc.

This, coupled with the remaining low interest rates means that there are many good investment opportunities around, particularly in areas where prices rises have been slower. Cash buyers who may be suffering losses in other financial investments, are also expected to turn to the property market.

Rental prices

Despite still being well below that of a year ago, rental prices throughout Barcelona are beginning to stabilise with some districts even showing a gradual increase at the end of the second quarter of the year compared to the first quarter.

According to Idealista, rental prices across the city as a whole remained unchanged at the end of June 2021 compared to the last quarter and the districts of Barcelona Old Town, Eixample, Horta Guinardó, Sant Martí and Sants-Montjuïc all registered small increases, of 1.4%, 0.5%, 0.3%, 2.4% and 1.0% respectively. The absence of foreigners and an increase in working from home has significantly reduced rental demand, however.

- – Sant Martí: €14.60 per square metre (2.4% increase)

- – Barcelona Old Town: €15.70 per square metre (1.4% increase)

- – Sants-Montjuïc: €13.80 per square metre (1.0% increase)

- – Eixample: €14.80 per square metre (0.5% increase)

- – Horta Guinardó: €12.30 per square metre (0.3% increase)

- – Gràcia: €14.10 per square metre (no change)

- – Les Corts: €13.90 per square metre (0.2% decrease)

- – Sarrià-Sant Gervasi €15.50 per square metre (0.4% decrease)

- – Sant Andreu: €11.90 per square metre (1.9% decrease)

- – Nou Barris: €11.70 per square metre (1.9% decrease)

“Both property prices and the numbers of sales are starting to increase across the city of Barcelona, confirming our prediction that the market would bounce back relatively quickly. The Barcelona property market depends on the vaccination programmes, both domestically and overseas, however but with life beginning to return to some sort of normality, we are confident the recovery will continue,” comments Francisco Nathurmal, CEO and founder of BCN Advisors.

Barcelona real estate market in 2023

Barcelona real estate market in 2023

Evolution of the Barcelona real estate market: Q4 2023

Evolution of the Barcelona real estate market: Q4 2023

Barcelona house price forecast 2024

Barcelona house price forecast 2024