Are you looking for the latest information about the evolution of the real estate market in Barcelona from the third quarter of 2025? Below, let’s take a look at what’s happened in the Barcelona property market from July to September 2025.

Spain’s property market continued to show its resilience in the third quarter of 2025. According to the latest data from Spain’s National Institute of Statistics (INE), home sales rose again in September 2025 after a 3.4% year-on-year decrease in August 2025, realigning with the upward trajectory that had marked 13 consecutive months of annual growth. Property transactions in September 2025 across Spain rose by 3.8% when compared to the same month in 2024, with 63,794 properties changing hands. This marks the highest figure for the month of Septemer since 2007 and the second highest monthly total of the year, behind only July.

This renewed growth was fuelled largely by a robust 10.8% surge in new home sales, reaching 13,823 transactions, the highest figure for a September since 2010. Sales of second-hand homes also contributed, rising 2% to 49,971 transactions, the highest September figure in 18 years.

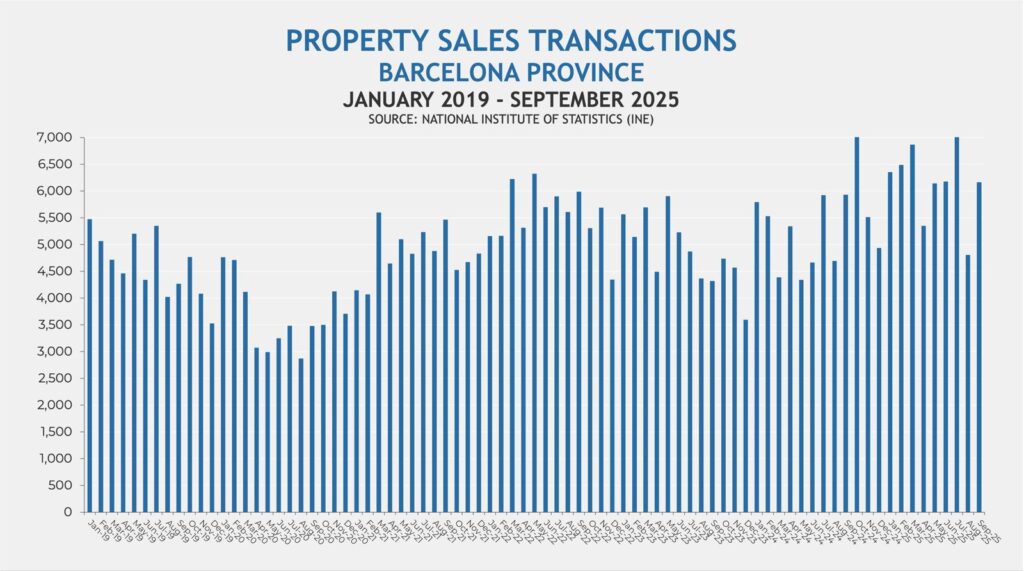

Increase in sales in the province of Barcelona in Q3 2025

The latest data from INE shows that Barcelona Province is closely mirroring the national trend. In September 2025, 6,164 properties changed hands, marking a 3.9% year-on-year increase. Growth was driven largely by the new home sector, which recorded a strong 13.7% rise, while second-hand sales saw an increase of 1.7%.

Looking at the broader picture, the first nine months of 2025 showed a notably active market. A total of 55,465 properties were sold, representing a 19% increase compared to the same period last year. New home sales jumped by 28.7%, reaching 10,978 transactions, and second-hand homes saw a solid 16.8% rise, with 44,487 transactions registered in the first nine months of the year.

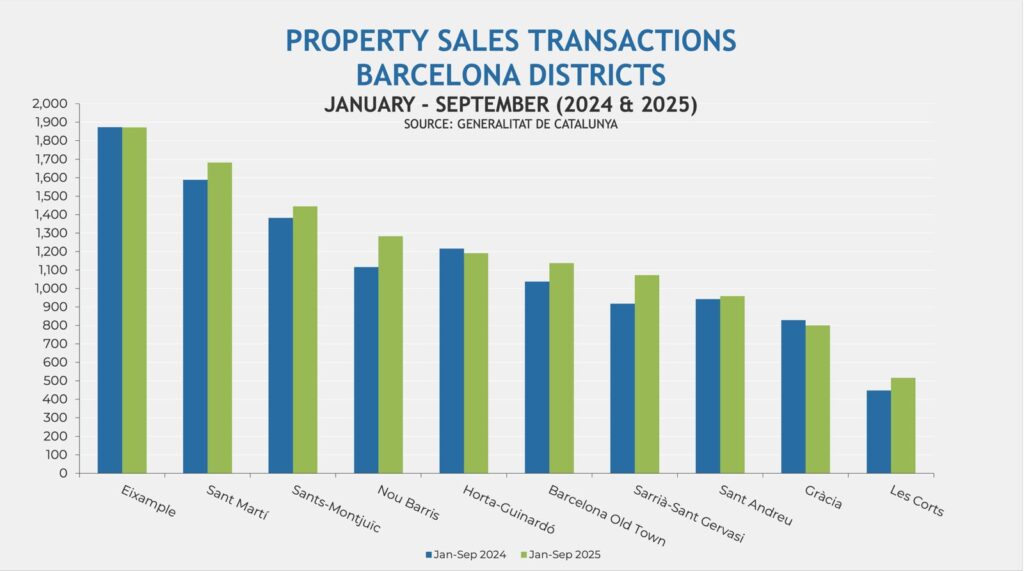

Sales also increase in the city of Barcelona in Q3 2025

The number of sales across the city of Barcelona also increased. According to the latest data from the Generalitat de Catalunya, the number of sales transactions rose by 5.2% when comparing the first three quarters of 2025 with the same period in 2024. Seven of the city’s ten districts recorded growth, led by Sarrià-Sant Gervasi with the largest increase (16.8%), followed closely by Les Corts (15.4%) and Nou Barris (15.1%). However, three districts saw slight declines in transaction volumes, in Eixample (-0.1%), Horta-Guinardó (-2.1%) and Gràcia (-3.5%).

– Sarrià-Sant Gervasi: 1,072 sales (16.78% increase)

– Les Corts: 517 sales (15.40% increase)

– Barcelona Old Town: 1,137 sales (9.54% increase)

– Sant Martí: 1,682 sales (5.92% increase)

– Eixample: 1,872 sales (0.05% decrease)

– Nou Barris: 1,284 sales (15.05% increase)

– Sants-Montjuïc: 1,444 sales (4.49% increase)

– Sant Andreu: 959 sales (1.70% increase)

– Horta-Guinardó: 1,191 sales (2.06% decrease)

– Gràcia: 800 sales (3.50% decrease)

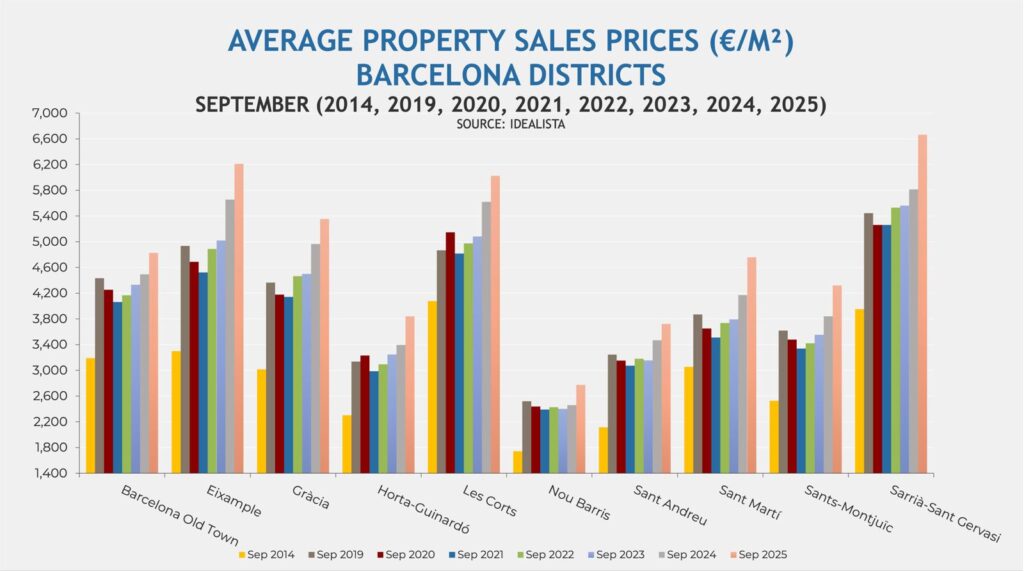

Price increases in the city of Barcelona in the Q3 2025

According to leading property portal Idealista, the average price of residential property in Barcelona reached €4,989 per square metre at the end of the third quarter of 2025, marking a 9.4% increase compared with the average price at the end of the third quarter of 2024. All ten of the city’s districts recorded year-on-year price growth by September 2025, with each also showing increases when compared to pre-pandemic levels seen in September 2019.

– Sarrià-Sant Gervasi: €6,661 per square metre (14.57% increase)

– Sant Martí: €4,756 per square metre (14.08% increase)

– Eixample: €6,210 per square metre (9.81% increase)

– Gràcia: €5,354 per square metre (7.86% increase)

– Barcelona Old Town: €4,826 per square metre (7.46% increase)

– Les Corts: €6,022 per square metre (7.15% increase)

– Horta-Guinardó: €3,840 per square metre (13.07% increase)

– Nou Barris: €2,774 per square metre (12.76% increase)

– Sants-Montjuïc: €4,321 per square metre (12.50% increase)

– Sant Andreu: €3,721 per square metre (7.33% increase)

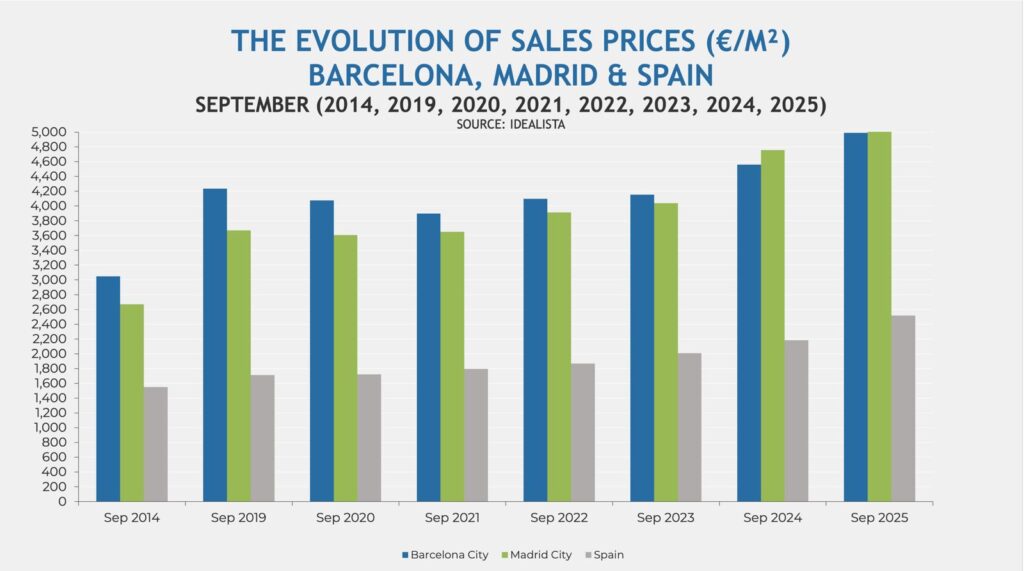

For the first time in many years, average property prices in Barcelona City fell below those in Madrid City at the end of September 2024 and that gap has widened over the past year. By September 2025, Barcelona’s average price stood at €4,989 per square metre, compared with €5,677 per square metre in Madrid.

Rental prices in the city of Barcelona in the Q3 2025

Barcelona’s rental market maintained its strong upward momentum, with rental prices climbing steadily across all of the city’s ten districts. By the end of September 2025, the citywide average had reached €24 per square metro, marking a 7.1% increase compared with the average price at the end of September 2024.

The strongest growth was recorded in Sant Andreu, where rental prices climbed 11.2% year-on-year to €17.9 per square metre. This was followed by Les Corts and Gràcia, with annual increases of 7.5% and 6.8% respectively.

– Les Corts: €21.4 per square metre (7.54% increase)

– Gràcia: €23.5 per square metre (6.82% increase)

– Sarrià-Sant Gervasi: €23.5 per square metre (6.33% increase)

– Eixample: €25.8 per square metre (5.31% increase)

– Sant Martí: €23.3 per square metre (4.95% increase)

– Barcelona Old Town: €26.0 per square metre (4.84% increase)

– Sant Andreu: €17.9 per square metre (11.18% increase)

– Horta-Guinardó: €17.7 per square metre (3.51% increase)

– Sants-Montjuïc: €20.7 per square metre (3.50% increase)

– Nou Barris: €15.7 per square metre (1.95% increase)

Foreign buyers in the city of Barcelona in the Q3 2025

Catalonia continues to stand out as one of Spain’s most attractive markets for international property buyers, according to the latest data from the Spanish Land Registry (Registradores). In the third quarter of 2025, the region once again secured its position as the fifth most popular destination for foreign buyers, just behind Murcia, the Canary Islands, the Valencian Community and the Balearic Islands.

The province of Barcelona maintained its strong appeal among overseas investors, with foreign buyers registering an interannual percentage of 14.18% of all transactions, almost twice the proportion seen in Madrid, where it was 7.11%.

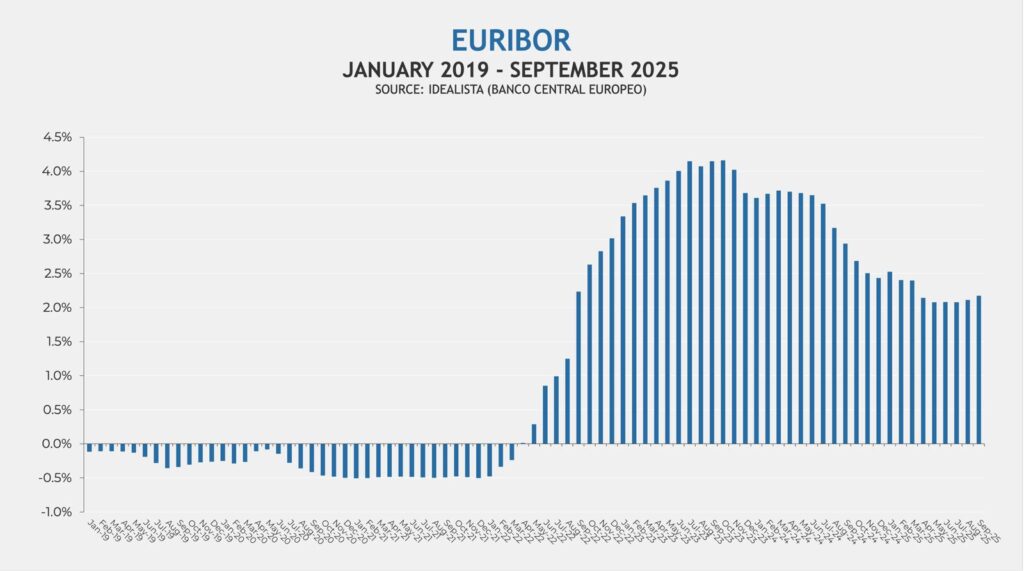

The 12-month Euribor, the key benchmark for most variable rate mortgages in Spain, stabilised through to the end of September 2025 at around 2.2% (Banco de España), after fluctuating higher earlier in the year. For property buyers this creates a more predictable environment, with typical mortgage rates (Euribor plus bank margin) often around 3% to 3.5%, thus making investment calculations clearer. Overall, the current Euribor level suggests a stable but not low-cost borrowing landscape, making careful yield analysis essential.

Barcelona property price forecast 2026

Barcelona property price forecast 2026

The Barcelona Property Market Q3 2025

The Barcelona Property Market Q3 2025

How to Sell an Apartment in El Born, Barcelona, and Attract the Most Interested Buyers

How to Sell an Apartment in El Born, Barcelona, and Attract the Most Interested Buyers