Are you looking for the latest information about the evolution of the real estate market in Barcelona from the first quarter of 2025? Below, let’s take a look at what’s happening in the Barcelona property market from January to March 2025.

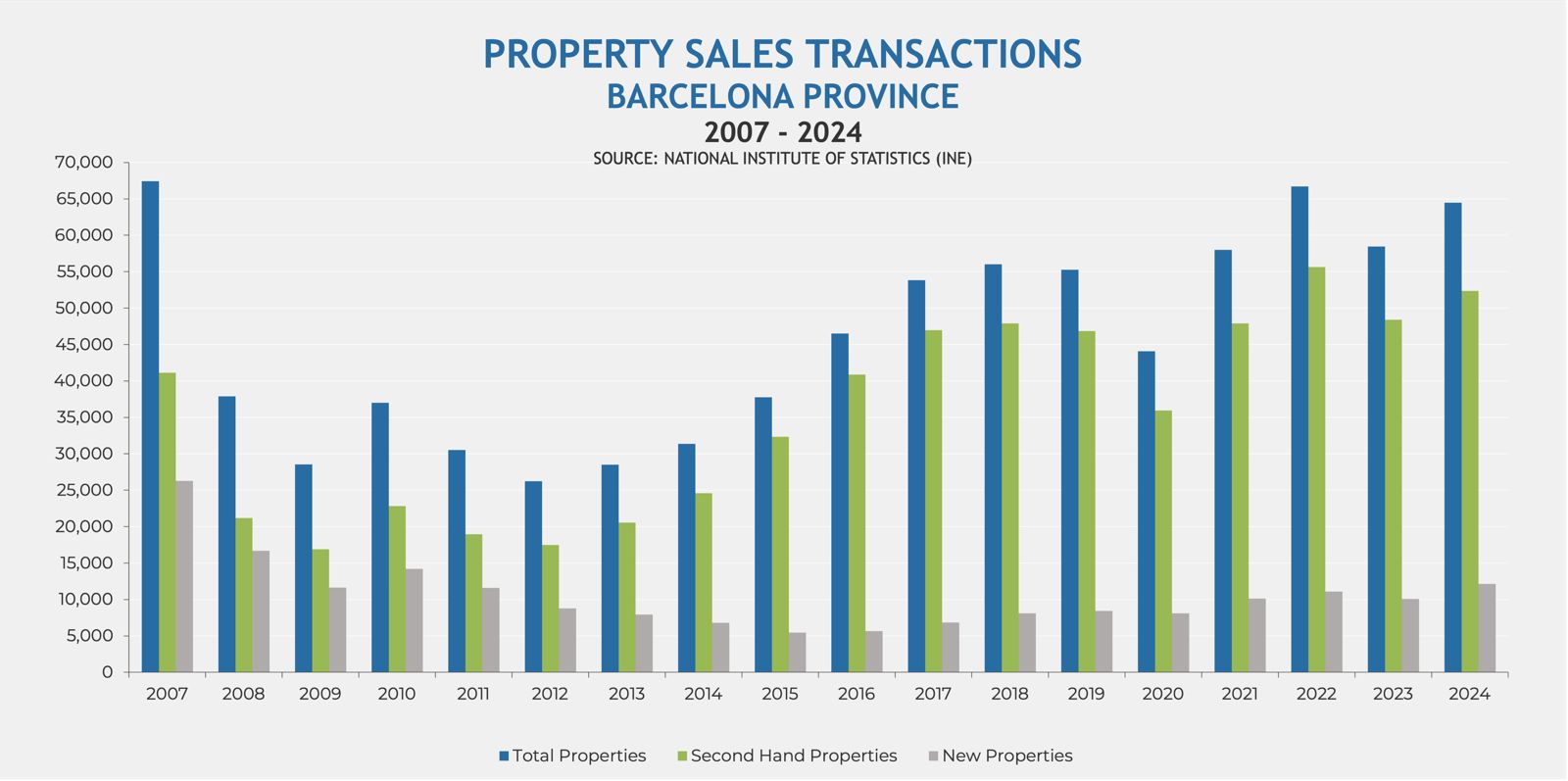

Spain’s residential property market has kicked off 2025 with remarkable strength, echoing momentum not seen since the mid-2000s. Sales and prices are nearing the highs of the 2007 property boom, yet the underlying economic conditions today are markedly more stable.

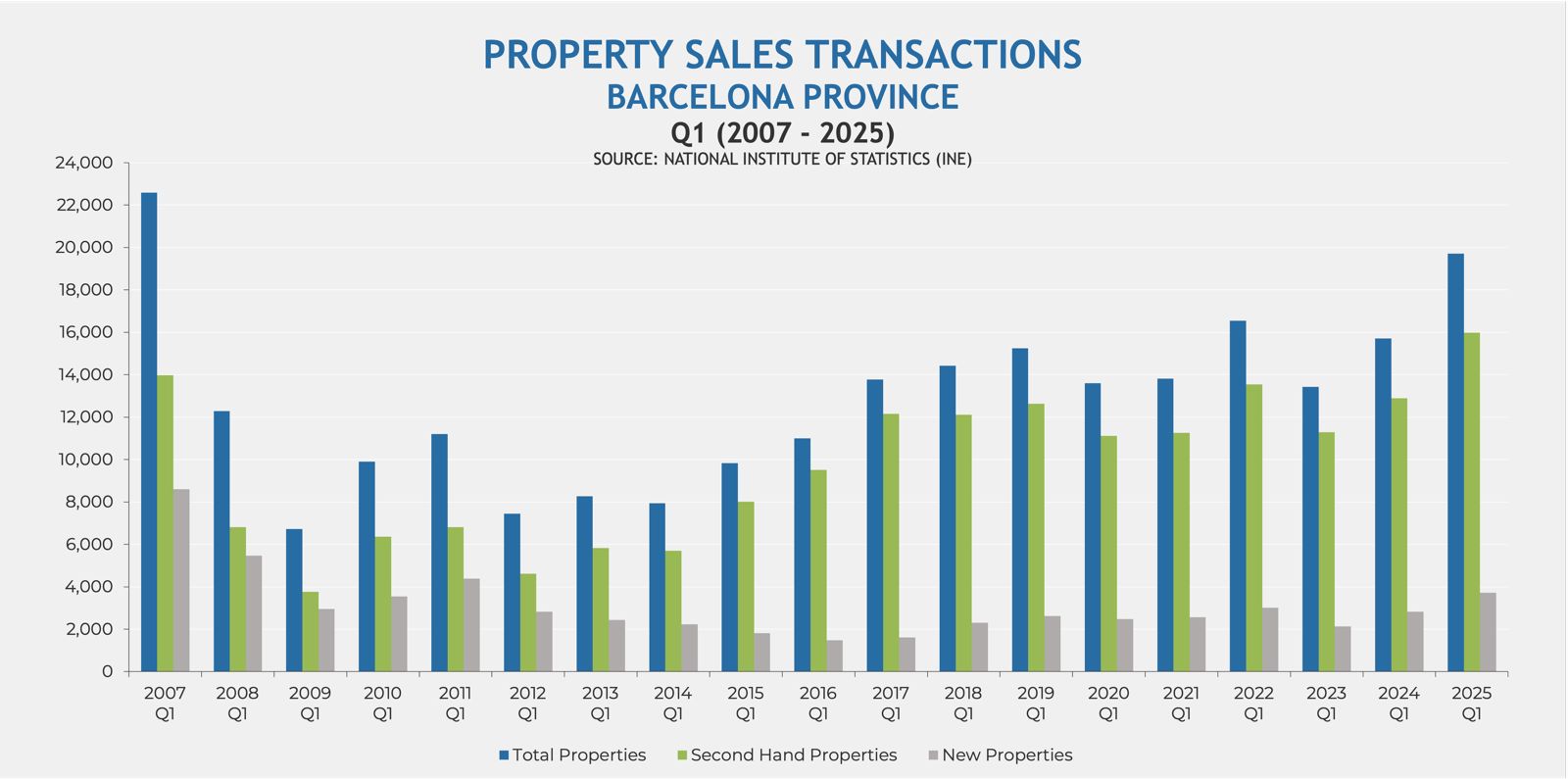

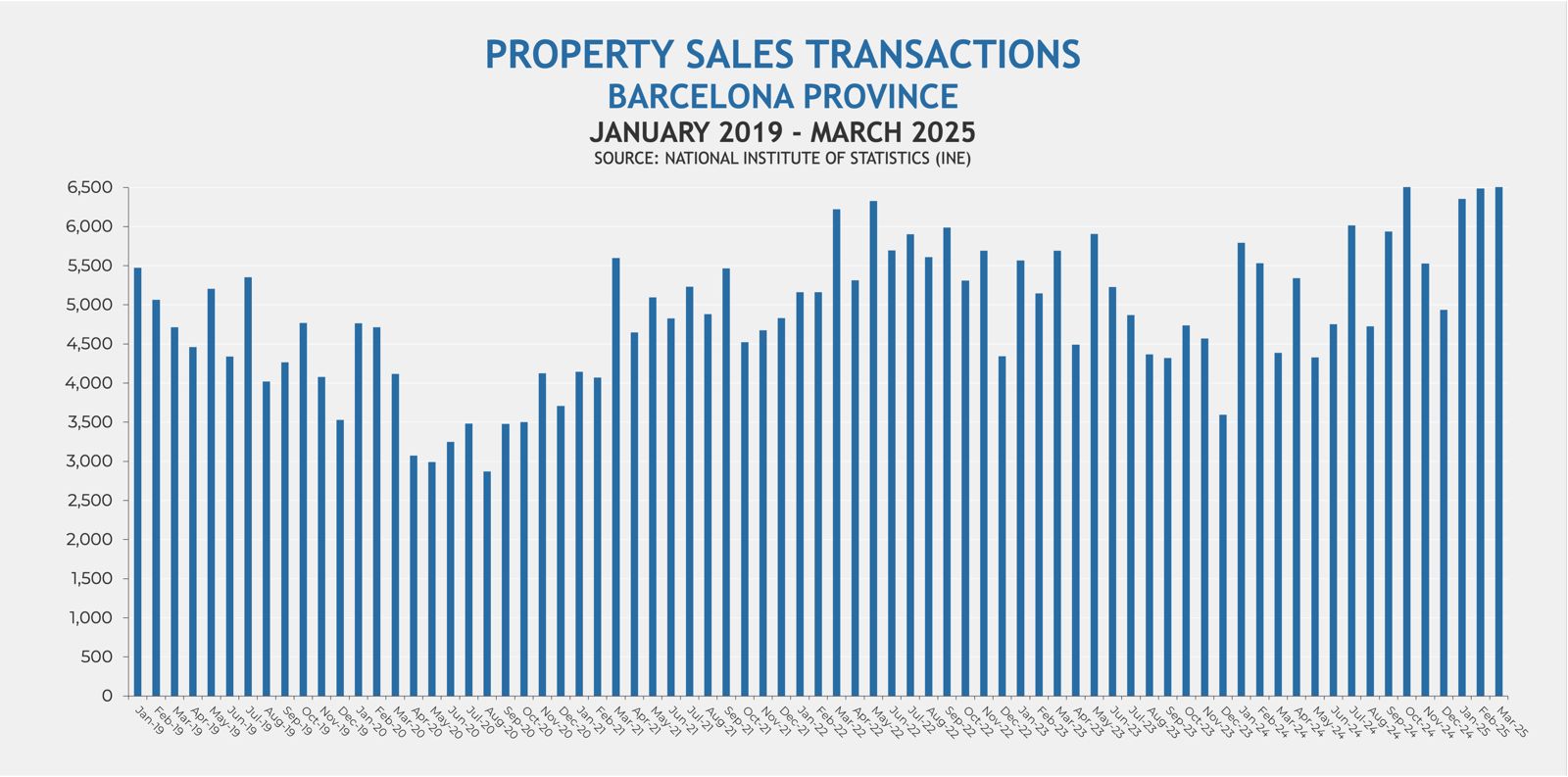

March 2025 saw a dramatic 40.6% year-on-year surge in home sales nationwide, totaling 62,808 transactions, the highest March total since 2007. Catalonia mirrored this trend with an even greater 52.3% year-on-year increase in sales, reaching 10,345 transactions in March 2025. The province of Barcelona also experienced strong growth, recording 19,708 home sales in the first quarter of 2025, a 25.4% rise compared to the same period last year.

Improved mortgage conditions

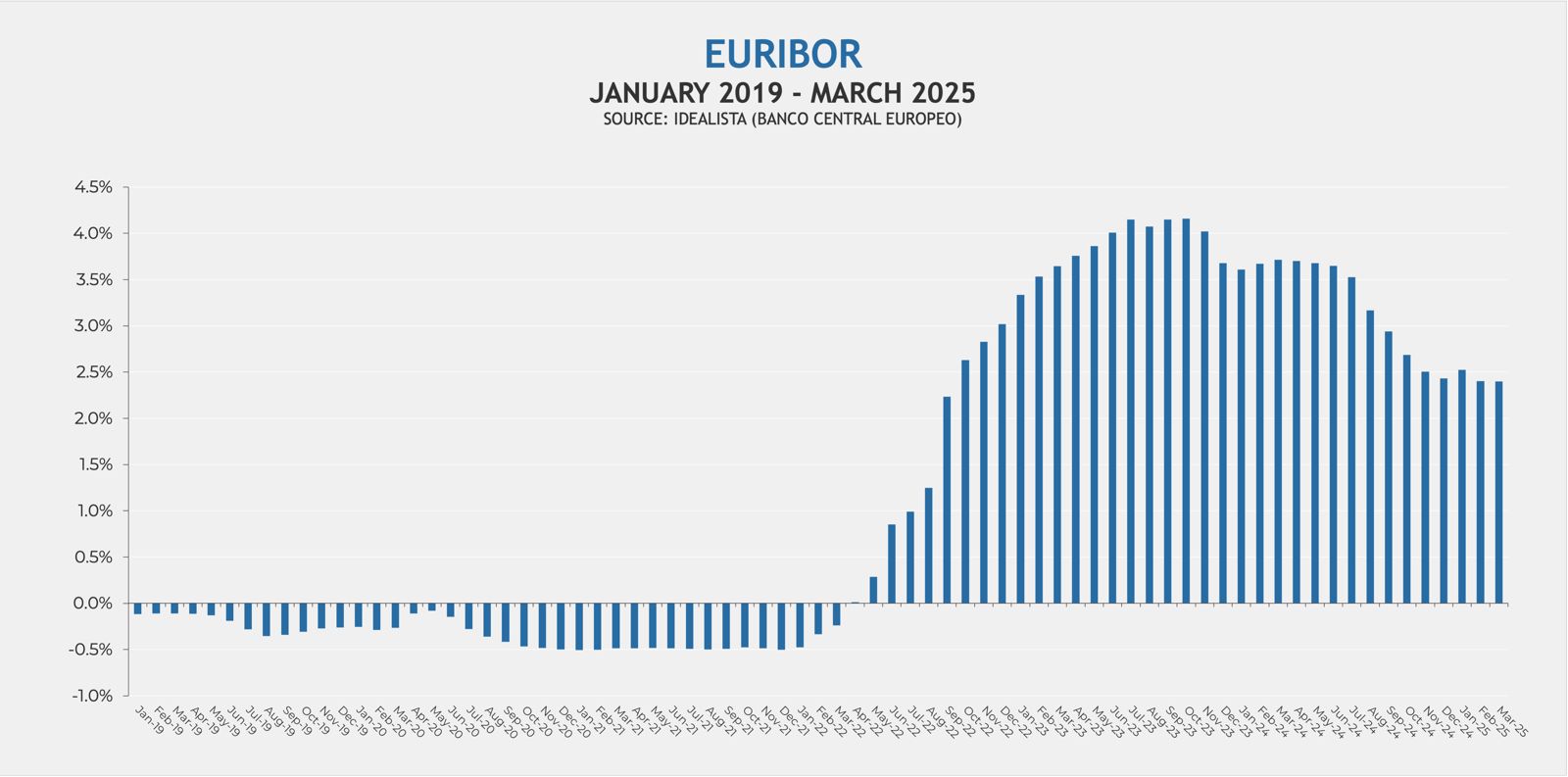

One of the key factors behind this surge is improved mortgage conditions. Major Spanish banks are now offering fixed-rate mortgages under 2%, with some even below 1.5%, a significant shift from the tighter credit environment of 2023. This drop in borrowing costs has opened the door for many potential buyers who had been waiting on the sidelines.

Spain’s macroeconomic backdrop is also fueling demand. The Bank of Spain reports rising employment (up 2.2%) and a 3.5% increase in real per capita income. Household debt levels remain low, access to financing is easier, and investor sentiment toward property remains strong. Many now view housing as a safe option amidst ongoing global economic uncertainties.

Barcelona sales of properties rise Q1 2025

The market’s strength is evident in both new and existing home transactions. In the first quarter of 2025, sales of new homes in the province of Barcelona jumped 32.0% year-on-year, while sales of second hand properties rose by 24.0%, showing robust demand across the board.

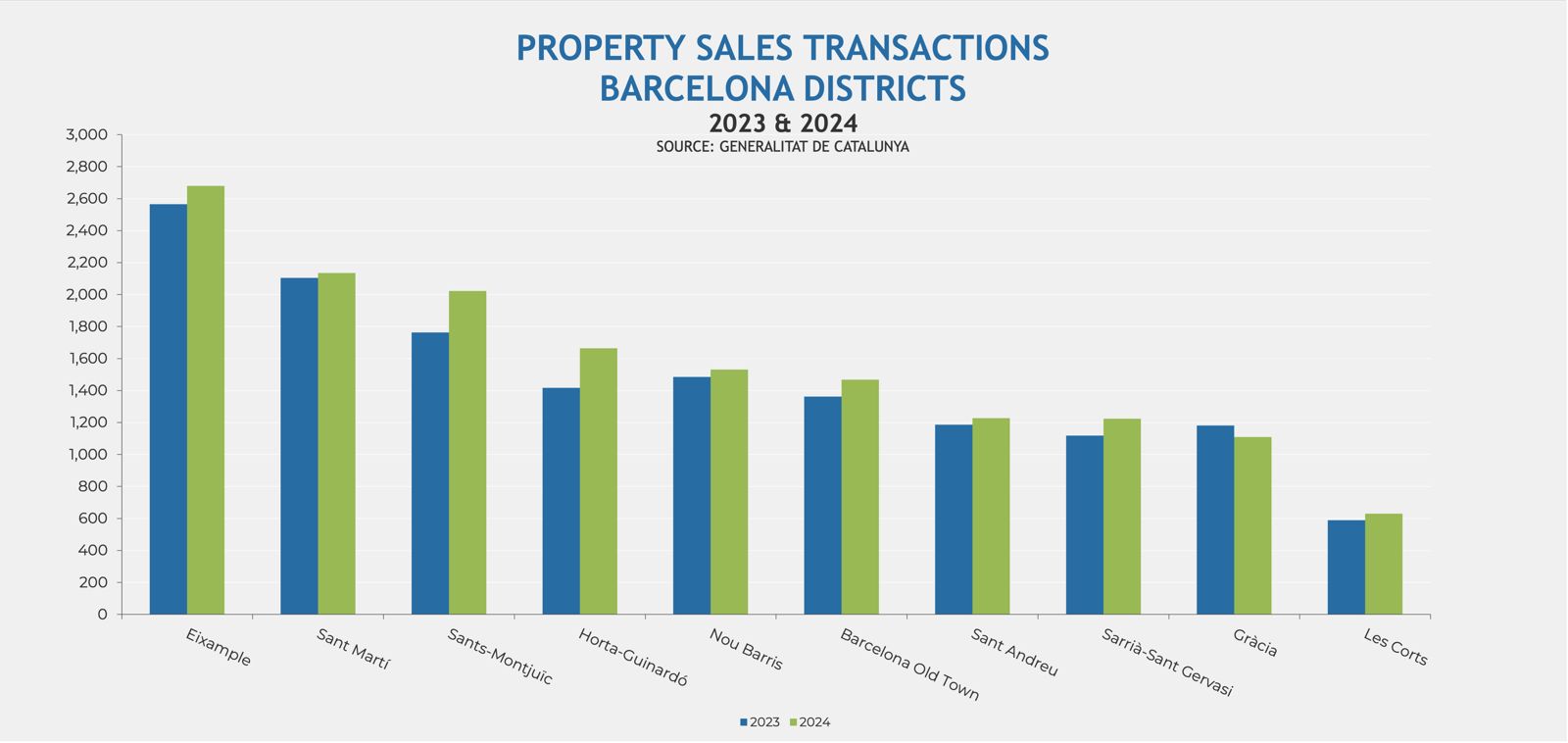

It remains to be seen whether home sales in the city of Barcelona itself have followed the same upward trend, as data from the Generalitat de Catalunya is not yet available. However, looking at figures for all of 2024, only one of the city’s ten districts saw a decline in sales compared to 2023. Once the data is released, it’s likely that similar trends to those seen nationally will emerge.

– Sarrià-Sant Gervasi: 1,224 sales (9.38% increase)

– Barcelona Old Town: 1,468 sales (7.78% increase)

– Les Corts: 631 sales (7.13% increase)

– Eixample: 2,679 sales (4.44% increase)

– Nou Barris: 1,531 sales (3.10% increase)

Sant Martí: 2,135 sales (1.47% increase)

– Gràcia: 1,110 sales (6.09% decrease)

– Horta-Guinardó: 1,664 sales (17.43% increase)

– Sants-Montjuïc: 2,022 sales (14.63% increase)

– Sant Andreu: 1,227 sales (3.37% increase)

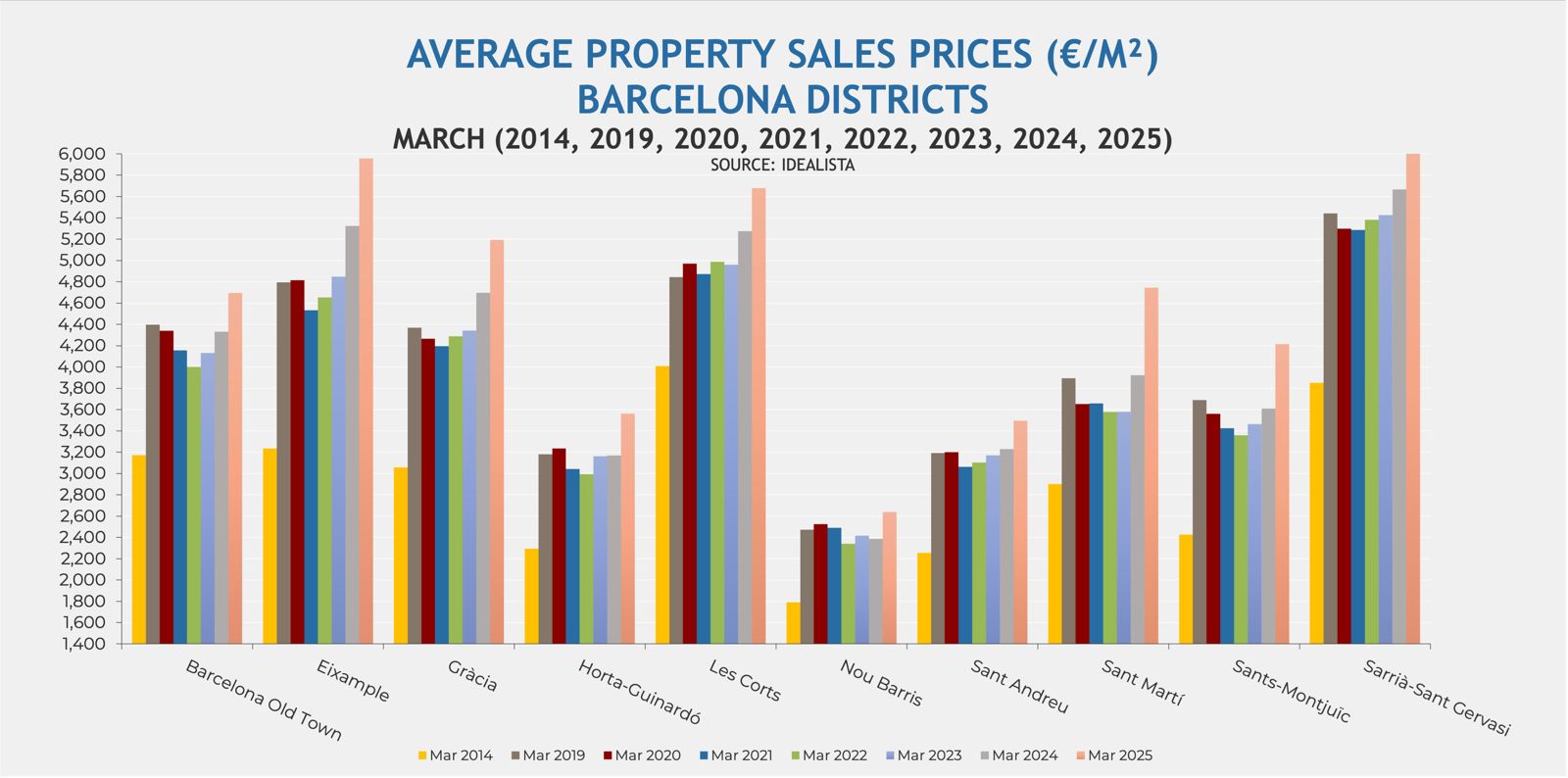

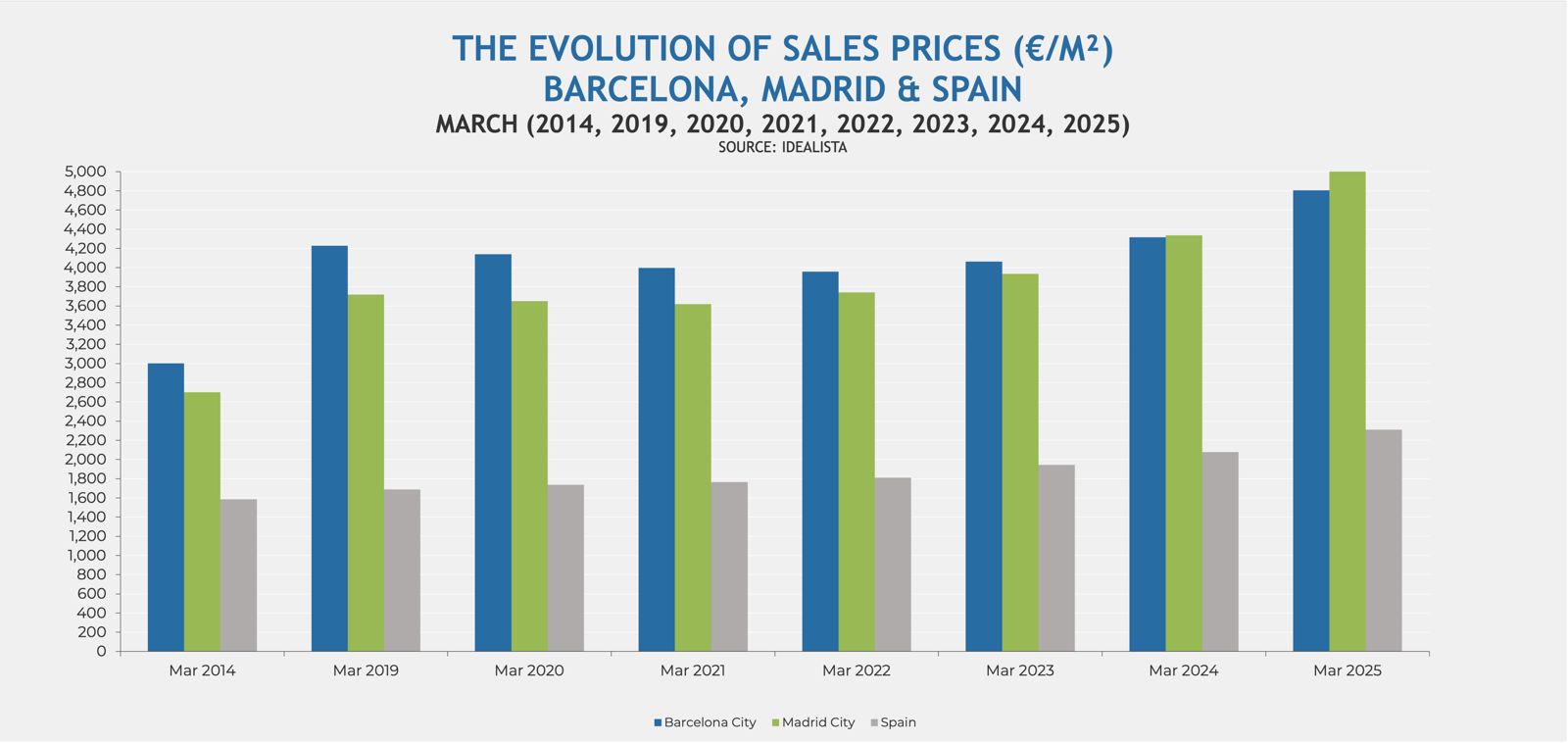

Barcelona Property Prices Q1 2025

According to Idealista, the average property price across the city of Barcelona as a whole reached €4,804 per square metre at the end of March 2025, marking an 11.3% increase compared to the average price at the end of March 2024. Average prices experienced growth across all of the city’s ten districts, with the district of Sant Martí once again leading with the highest increase.

– Sant Martí: €4,743 per square metre (20.90% increase)

– Eixample: €5,957 per square metre (11.87% increase)

– Gràcia: €5,193 per square metre (10.58% increase)

– Sarrià-Sant Gervasi: €6,210 per square metre (9.60% increase)

– Barcelona Old Town: €4,695 per square metre (8.38% increase)

– Les Corts: €5,680 per square metre (7.68% increase)

– Sants-Montjuïc: €4,214 per square metre (16.73% increase)

– Horta-Guinardó: €3,563 per square metre (12.40% increase)

– Nou Barris: €2,639 per square metre (10.60% increase)

– Sant Andreu: €3,496 per square metre (8.27% increase)

By the end of March 2025, Madrid’s average property price reached €5,321 per square metre, notably higher than Barcelona’s and marking a 22.8% year-on-year increase.

Barcelona Rental Prices Q1 2025

According to Idealista, rental prices registed an annual increase in all ten of Barcelona’s districts at the end of March 2025, with the highest rise in the highly desirable Eixample district where rents surged by 20.1% compared to March 2024. Across the city as a whole the average rental prices registered a year-on-year increase of 15.5%, reaching €23.9 per square metre by the end of March 2025.

– Eixample: €26.3 per squre metre (20.09% increase)

– Gràcia: €23.3 per squre metre (14.22% increase)

– Sarrià-Sant Gervasi: €23.6 per squre metre (11.85% increase)

– Sant Martí: €23.1 per squre metre (10.00% increase)

– Barcelona Old Town: €25.0 per squre metre (7.30% increase)

– Les Corts: €20.9 per squre metre (6.63% increase)

– Sant Andreu: €17.7 per squre metre (12.03% increase)

– Sants-Montjuïc: €20.7 per squre metre (8.38% increase)

– Nou Barris: €16.2 per squre metre (4.52% increase)

– Horta-Guinardó: €17.1 per squre metre (1.79% increase)

Foreign buyers in Barcelona Q1 2025

Data from the Spanish Land Registry (Registradores) showed that by the end of the first quarter of 2025 the interannual percentage of foreign buyers in the province of Barcelona reached 14.5%, nearing double the market share in the first quarter of 2021 when it was 8.34%.

The proportion of foreign buyers remains signicantly higher in the province of Barcelona than in the Community of Madrid, where the interannual percentage at the end of the first quarter of 2025 was 7.4%.

Euribor evolution in Barcelona Q1 2025

Over the past year leading up to the end of Q1 2025, the Euribor experienced a notable decline. The 3-month Euribor, for instance, decreased from approximately 3.9% at the beginning of 2024 to around 2.56% by March 2025. This downward trend reflects the European Central Bank’s monetary policy adjustments aimed at stimulating economic growth amid evolving economic conditions . This decline in Euribor rates has had a significant impact on the real estate market, particularly in regions like Barcelona. Lower borrowing costs have made mortgages more affordable, contributing to increased property transactions and a surge in housing demand.

EURIBOR

JANUARY 2019 – MARCH 2025

As we look ahead, Barcelona and Spain’s property markets seem poised for continued growth. Whether 2025 sets new records remains to be seen, but the fundamentals are solid, and buyer confidence is clearly on the rise.

According to Francisco Nathurmal, CEO and founder of Bcn Advisors: “The upturn we’ve seen in Barcelona’s property market in the first quarter of the year is eye opening. With sales volumes rising over 25% year-on-year, prices continuing to rise and confidence returning across the board, it’s clear we’re witnessing a new phase of sustainable growth. Improved mortgage conditions, solid economic fundamentals, and renewed interest from both domestic and international buyers have converged to create one of the most ynamic property environments we’ve seen in nearly two decades.”

Barcelona property price forecast 2026

Barcelona property price forecast 2026

The Barcelona Property Market Q3 2025

The Barcelona Property Market Q3 2025

How to Sell an Apartment in El Born, Barcelona, and Attract the Most Interested Buyers

How to Sell an Apartment in El Born, Barcelona, and Attract the Most Interested Buyers