Are you looking for information about the housing price forecast in Barcelona in 2026? Find out if 2026 is the year to buy, sell or invest in real estate in Barcelona and Spain.

Bcn Advisors looks at some of the trends and predictions for the Barcelona Property Market in 2026. It will be a year of stability, confidence and selective growth

1. Transaction growth will continue but at a more measured pace

According to data from the from Spain’s National Institute of Statistics (INE), Barcelona Province saw transactions in the first three quarters of 2025 rise by 19% when compared to the same period in 2024, with 55,465 properties exchanging hands. This was largely driven by a 28.7% surge in sales of new homes.

In Barcelona city, the recovery was equally evident. According to the Generalitat de Catalunya, residential sales in Barcelona rose by 5.2% in the first three quarters of 2025 compared with the same period last year. Growth was broad-based across the city, with seven of Barcelona’s ten districts recording higher transaction volumes.

Demand was particularly strong in the city’s most sought-after residential areas. Sarrià-Sant Gervasi led the market with a 16.8% increase, followed by Les Corts (15.4%) and Nou Barris (15.05%). Ciutat Vella (Barcelona Old Town) also saw robust activity, with sales rising by 9.5%, while Sant Martí, one of the city’s main regeneration and development zones, recorded a 5.9% increase.

By contrast, three centrally located districts showed marginal declines: Eixample (-0.1%), Horta-Guinardó (-2.1%) and Gràcia (-3.5%), suggesting that some sub-markets may be approaching short-term saturation after several years of strong growth rather than signalling any structural slowdown.

Prediction

In 2026, transaction numbers are expected to increase again, though likely at a slightly slower pace. As mortgage rates stabilise and consumer confidence continues to rise, demand is likely to remain strong, especially in the new homes sector.

2. Price growth will remain positive, especially in prime and emerging districts

One of the defining trends of 2025 was the continued resilience and strength of prices across Barcelona’s residential market. According to multiple market indicators, average prices per square metre in Barcelona City approached or exceeded €5,000 in late 2025, with sustained year-on-year increases well above national averages.

By the end of 2025, data from property portal Idealista showed the citywide average price as €5,144 per square metre, with a strong annual increase, and all ten districts recording growth compared with 2024 and pre-pandemic levels.

District performance highlights include:

– Sarrià-Sant Gervasi: Among the highest price tiers in the city, with Idealista recording an average price of €6,814 per square metre at the end of 2025.

– Les Corts and Eixample: Prime central districts showing robust pricing, with Idealista recording average prices of €6,308 per square metre and €6,322 per quare metre respectively, driven by sustained demand for quality residences.

– Sant Martí: A strong performing emerging area with prices averaging at €4,897 at the end of 2025, reflecting its appeal and ongoing regeneration.

– Horta-Guinardó and Nou Barris: Average prices of €3,863 per square metre and €2,956 per square metre respectively at the end of 2025, showing significant growth potential as they remain more affordable yet increasingly desirable thanks to relative value and infrastructure improvements.

Prediction

Looking into 2026, prices in Barcelona are expected to continue rising, though likely at a more moderate pace than the double-digit growth seen in parts of 2024 and 2025. A citywide growth range of approximately 3% to 6% is a realistic expectation, supported by sustained demand, constrained supply and solid economic growth.

Overall, the structural shortage of housing in Barcelona coupled with limited land for new development is expected to keep upward pressure on prices through 2026, albeit more gradually than peak growth rates observed in recent years.

3. Rental regulation will reshape — not weaken — Barcelona’s market

Barcelona’s rental market entered 2025 under intense pressure, with demand far exceeding available supply. By the end of 2025, average rents across the city as a whole reached €23.8 per square metre, according to property portal Idealista, reflecting a 1.9% year-on-year increase and confirming that underlying demand remained strong across the city. Price growth was visible across nine of the city’s ten districts, with particularly strong rises in Sant Andreu (5.6%), Les Corts (5%), Horta-Guinardó (4.4%) and Eixample (3.8%).

However, the most important shift now shaping the rental market is not demand, it is regulation. In 2025, Catalonia implemented new rental price caps in ‘tensioned’ housing zones, including most of Barcelona. Under the new framework:

– New leases for existing properties are tied to a government reference index

– Annual rent increases are capped

– Landlords face restrictions on raising rents when tenants change

This means that headline rental prices will no longer rise freely, even though tenant demand continues to grow. Rather than cooling the market, these rules are already producing three powerful side effects:

– Long-term rental supply is shrinking : Many landlords are withdrawing properties from the long-term rental market, switching to temporary contracts or selling. This reduces supply further and increases competition for the limited number of regulated long-term units.

– Quality properties are becoming scarcer: Landlords who remain in the capped system are less willing to invest in upgrades, which means renovated, high-quality homes are becoming rarer and therefore more sought after by tenants and buyers alike.

– Buyers are being pushed into ownership : As access to good quality rentals becomes harder, more households are being pushed toward buying instead of renting, particularly in middle class and family This increases demand in the sales market, especially for well-located, move-in-ready properties.

While rent caps will limit how fast rents can rise on paper, they are likely to support property prices by: pushing more households into buying, reducing rental stock and increasing the relative value of renovated, regulation-compliant homes.

In effect, the policy shifts pressure from rents to sales.

Prediction

Rather than headline rents rising across the board, the more realistic outcome for 2026 is:

– Regulated long-term rents: Modest increases in line with the index.

– Unregulated segments (temporary, premium, corporate, renovated homes): Continued strong pricing.

– Sales market: Stronger buyer demand as renting becomes less accessible.

Luxury and executive rental demand will also remain resilient, particularly for renovated homes, as corporate relocations, international professionals and digital workers continue to target Barcelona as a lifestyle city.

4. Foreign buyer interest will strengthen

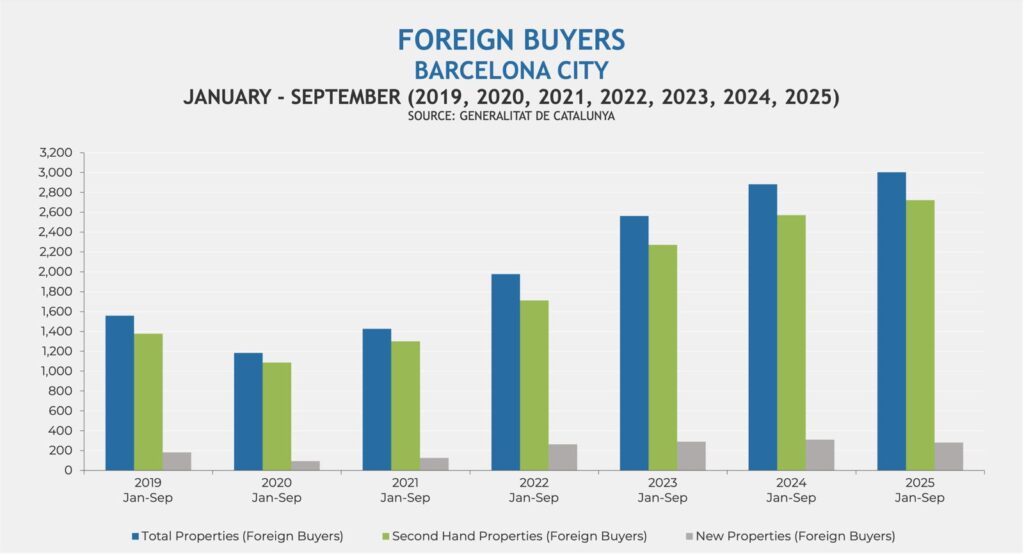

The latest data from the Generalitat de Catalunya shows that international buyers continue to play a dominant role in Barcelona’s property market. In the first three quarters of 2025, there were 3,002 foreign buyers in the city of Barcelona, from which 2,721 bought resale homes and 281 new homes. This compares to 1,425 foreign buyers in the same period in 2021.

This confirms that Barcelona remains one of Europe’s most internationally driven housing markets, with overseas capital providing a major source of liquidity and price support.

Prediction

Given the scale of foreign demand already in the market, the foreign buyer market will continue to be a key driver in 2026. With financing conditions stabilising and global mobility improving, overseas buyers are likely to continue supporting transaction volumes and prices, particularly in well-located and investment-grade properties.

5. Mortgage stability will bring greater buyer confidence

After several years of volatility, mortgage financing conditions in Spain are showing greater stability entering 2026, which is a positive signal for buyer confidence and housing demand.

The 12-month Euribor – the benchmark for most variable rate mortgages in Spain – has stabilised around 2.24% to 2.26% as of early 2026, continuing the downtrend seen throughout 2025 and sitting far below the peaks experienced in earlier years.

This steadier benchmark has translated into more predictable mortgage costs, with many banks quoting average borrowing rates for new mortgages around 2.9% to 3.1% in late 2025.

What this means for buyers and the market in 2026

– More predictable borrowing costs: With Euribor relatively stable and no dramatic spikes in sight, buyers can make longer term financial plans with greater certainty, reducing the fear of abrupt increases in monthly mortgage costs.

– Affordability modestly improved: Mortgage rates in the 2.9% to 3.1% range — for variable or mixed products — are lower and more predictable than the heightened levels seen in recent years, helping marginal buyers re-enter the market or move up within it.

– Support for first time buyers: Lower uncertainty and steadier monthly payments can encourage first time buyers who paused decisions during periods of high Euribor volatility to resume their search.

– Continued investor interest: Investors seeking long-term returns will find financing conditions more manageable — particularly for buy-to-let and renovation-plus-resale strategies — as lending costs stabilise.

– Upgrade demand: Buyers trading up from smaller flats to larger family homes, especially in commuter and outer-borough districts, are likely to feel more confident locking in financing with predictable monthly payments.

Prediction

This environment supports ongoing demand in the sales market, helping sustain price growth even if it moderates from the double-digit rates seen in recent years. Overall, the outlook for 2026 is that borrowing conditions will remain stable or gradually improve, encouraging a broader range of buyers, from first timers to long-term investors, to re-enter the market with renewed confidence.

6. Demand for new homes will continue to outpace supply

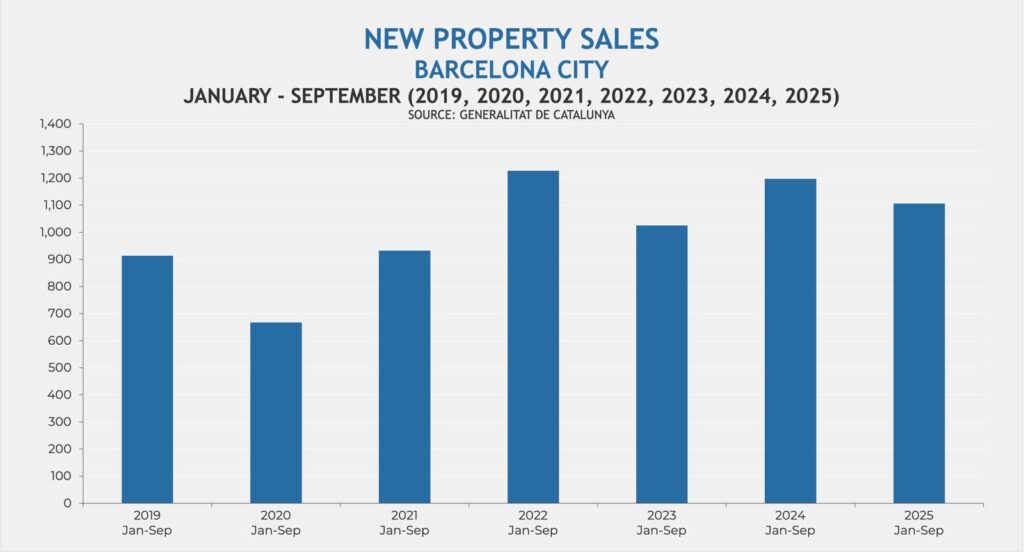

According to official Barcelona City data from the Generalitat de Catalunya, new home sales totalled 1,106 transactions in the first nine months of 2025, compared with 1,197 in the same period of 2024 and 1,025 in 2023, indicating that demand remains above pre-2024 levels but has softened due to limited supply. This confirms that buyer demand for modern, energy-efficient housing remains robust, despite higher prices and more restrictive financing conditions in recent years.

However, the pace of growth is now being limited by supply rather than demand. Land scarcity within the city, lengthy planning approvals, rising construction costs and regulatory uncertainty continue to restrict the number of new developments coming to market. As a result, sales growth has slowed not because buyers have disappeared, but because there simply are not enough new homes being delivered.

Prediction

In 2026, demand for new homes in Barcelona will continue to exceed available supply, particularly for: energy-efficient homes, well-located developments and family-sized and premium properties.

This imbalance will sustain upward pressure on prices and keep new homes selling quickly, often before completion. While transaction growth may stabilise, pricing power for developers and investors is likely to remain strong, reinforcing new homes as one of the most resilient segments of Barcelona’s housing market.

“Bringing together the trends from 2025, Barcelona is heading into 2026 with sales volumes still rising, albeit at a steadier pace, alongside moderate but sustainable price growth, continued strong rental demand, supportive financing conditions and continued international buyer interest. New-build homes will remain a premium asset and despite ongoing challenges such as limited supply, regulatory uncertainty and affordability pressures, the market’s overall direction points clearly toward stability, opportunity and long-term growth.”, says Francesco Nathurmal, founder and CEO of Bcn Advisors.

Barcelona property price forecast 2026

Barcelona property price forecast 2026

Les 10 meilleurs penthouses de luxe à Barcelone

Les 10 meilleurs penthouses de luxe à Barcelone

Les meilleurs clubs de luxe de Barcelone

Les meilleurs clubs de luxe de Barcelone